2022 tax brackets

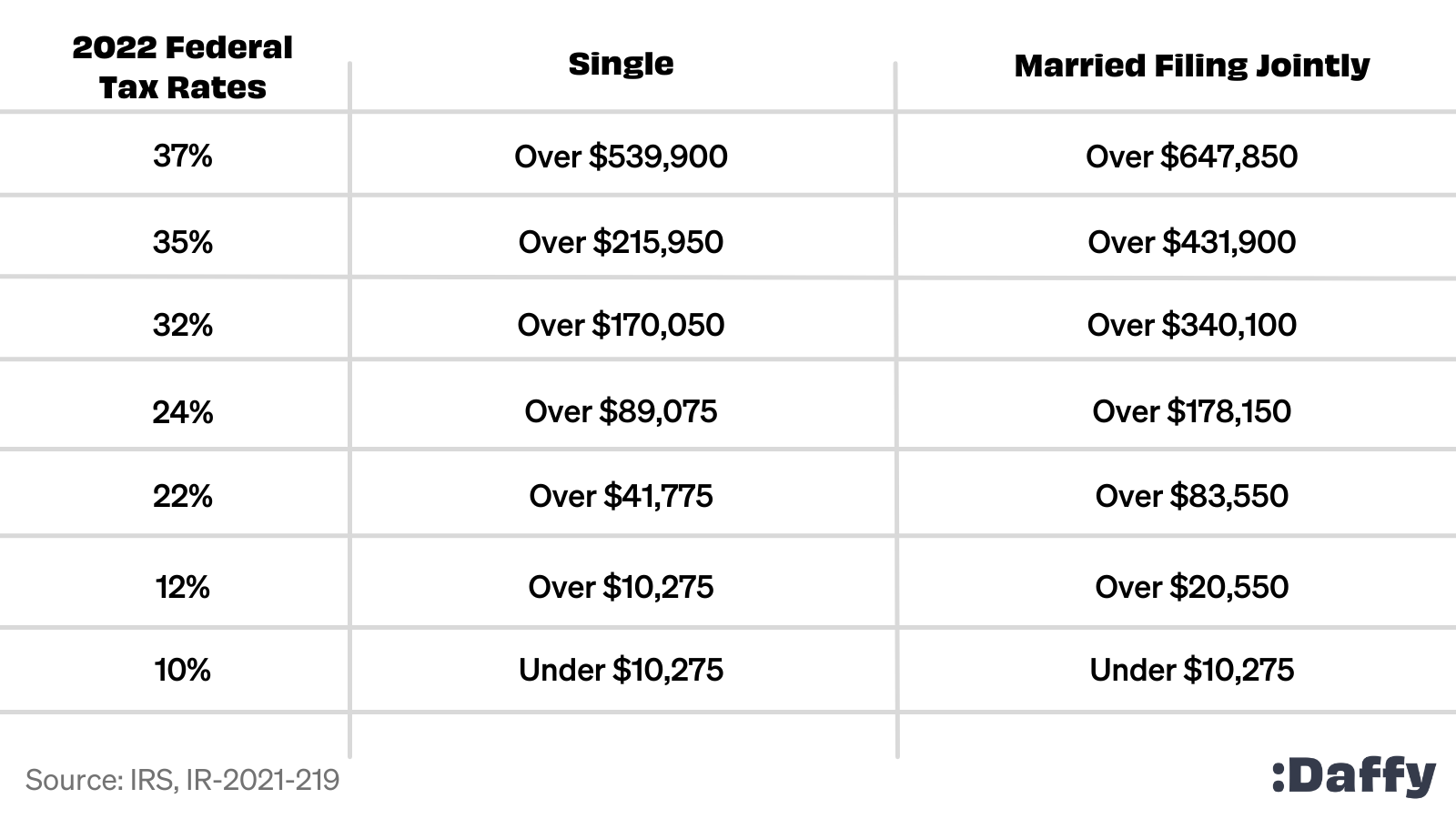

10 12 22 24 32 35 and 37. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax.

Federal Income Tax Brackets For 2022 And 2023 The College Investor

32 for incomes over 170050 340100 for married couples filing jointly.

. Residents These rates apply to individuals who are Australian residents for tax purposes. The current tax year is from 6 April 2022 to 5 April 2023. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year.

To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax. Heres how they apply by filing status. Taxable income up to 20550 12.

Your tax-free Personal Allowance The standard Personal Allowance is 12570. Each of the tax brackets income ranges jumped about 7 from last years numbers. There are seven federal income tax rates in 2023.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 24 for incomes over. The income brackets though are adjusted slightly for inflation.

18 hours agoArnold says the IRS is pushing up 2023 tax brackets by about 7 percent. The top marginal income tax rate. These are the rates for.

1 day agoThe standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. Here are the new brackets for 2022 depending on your income and filing status. For married individuals filing jointly.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. So it is stuck at the same level it was in 2022 Arnold said. 21 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

For couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announced. Your bracket depends on your taxable income and filing status. Below you will find the 2022 tax rates and income brackets.

There are seven federal tax brackets for the 2021 tax year. 21 hours ago2022 tax brackets for individuals Individual rates. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. There are seven federal income tax rates in 2022. Single filers may claim 13850 an increase.

35 for incomes over 215950 431900 for married couples filing jointly. 10 12 22 24 32 35 and 37. Single tax rates 2022 AVE.

In addition the standard deduction will rise to 13850 for single filers for the 2023 tax year from 12950 the previous year. If you can find 10000 in new deductions you pocket 2400. Single taxpayers and married.

The agency says that the Earned Income. The standard deduction for couples filing. 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 1 day agoSo for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. Heres a breakdown of last years income.

Resident tax rates 202223 The above rates do not include the Medicare levy of 2. 19 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. That puts the two of you in the 24 percent federal income tax bracket.

This guide is also available in Welsh Cymraeg. You and your spouse have taxable income of 210000.

2022 Income Tax Brackets Darrow Wealth Management

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Key Tax Figures For 2022 Putnam Wealth Management

The Complete 2022 Charitable Tax Deductions Guide

2021 2022 Tax Brackets And Federal Income Tax Rates

Understanding Marginal Income Tax Brackets The Wealth Technology Group

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

Tax Brackets For 2021 And 2022 Ameriprise Financial

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

2021 2022 Federal Income Tax Brackets And Rates Wsj

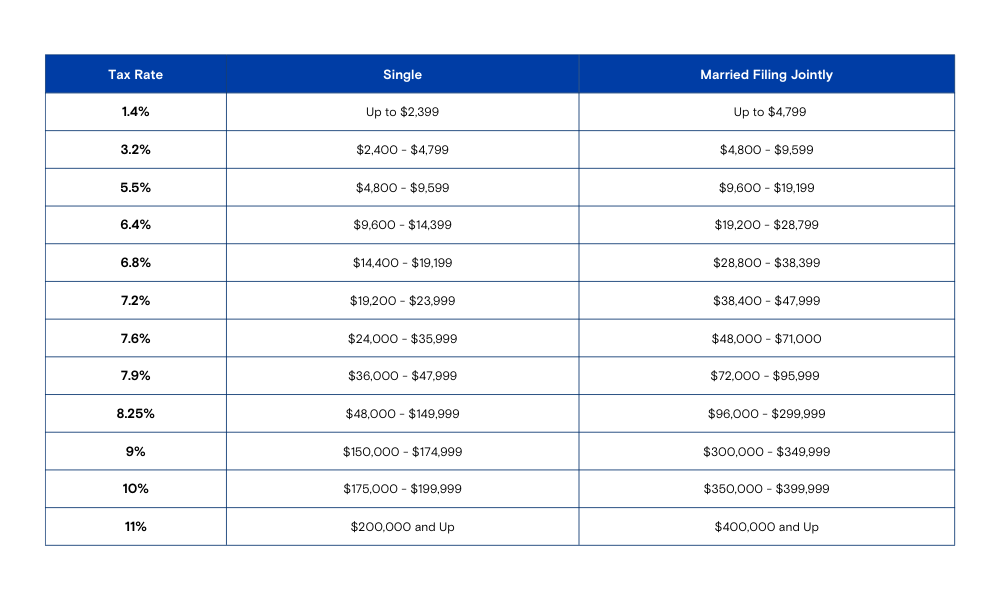

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

How Do Tax Brackets Work And How Can I Find My Taxable Income

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

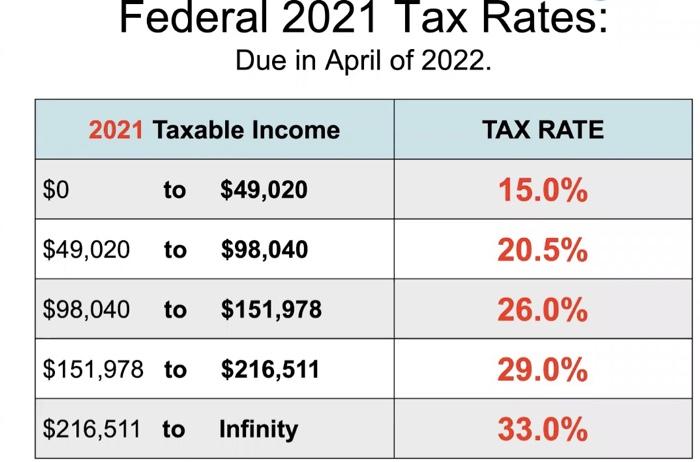

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com